Tulip Mania: The World’s First Market Bubble – When People Sold Houses for Flowers

- Cătălina Ciobanu

- Sep 30, 2025

- 5 min read

Flowers Worth More Than Gold

In the winter of 1636, a single tulip bulb in the Dutch Republic could be worth more than a skilled craftsman’s yearly wage. Rare bulbs were traded for carriages, houses, and even estates. Men and women huddled in taverns not to drink, but to speculate on the price of flowers that had yet to bloom. Contracts were signed for bulbs still in the ground, fortunes made and lost in a single night.

This was Tulip Mania, the world’s first great financial bubble, a moment when beauty, rarity, and speculation collided in one of history’s strangest economic frenzies. It lasted only a short while, but it left behind a legend: that people once sold houses for flowers, and that greed, no matter the century, always blooms faster than reason.

The Dutch Golden Age: Wealth, Trade, and Curiosity

The setting for Tulip Mania was the Dutch Republic of the 17th century, a nation in the midst of its Golden Age. Amsterdam was a global hub of trade, its ships carrying spices, silks, and silver from the farthest corners of the world. The Dutch were pioneers in finance, inventing stock exchanges, joint-stock companies, and modern banking systems. Wealth flowed into the cities, where merchants adorned their homes with art, maps, and exotic curiosities.

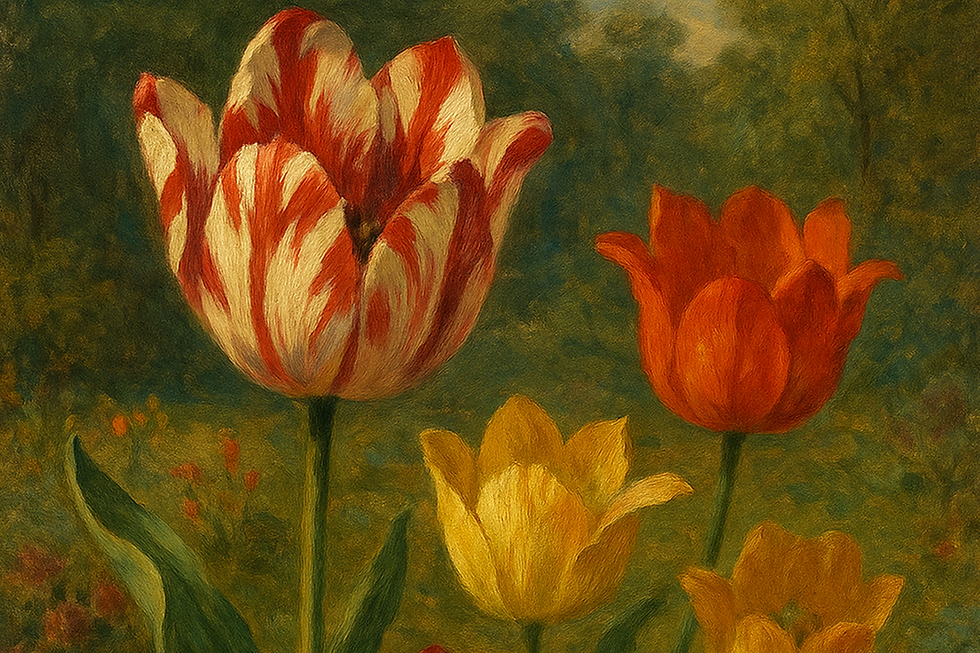

Tulips, newly introduced from the Ottoman Empire, became part of this culture of fascination. Unlike other flowers, tulips had a dramatic, simple elegance, their bold colors and striking shapes unlike anything Europe had seen before. When gardeners discovered that tulips could develop unique, “broken” patterns in their petals — streaks of flame-like color caused by a virus — they became irresistible. Each bulb was different, unpredictable, and rare. To a society obsessed with status and novelty, tulips were more than flowers. They were jewels that grew in the soil.

The Rise of the Tulip Trade

At first, tulips were luxury items, cultivated in the gardens of the wealthy. But as their allure spread, the trade expanded. Bulbs could be sold for astonishing sums, especially rare varieties with unusual colors. Contracts began to appear, allowing buyers to purchase bulbs while they were still in the ground. This “futures market” meant people could speculate without ever seeing the flowers themselves.

Taverns became trading houses. Merchants, artisans, and even laborers entered the game, hoping to buy low and sell high before the bulbs were lifted from the soil in summer. Stories spread of men selling their businesses or homes to invest in tulips, of sailors mistakenly eating bulbs worth fortunes, of fortunes made overnight.

In truth, not everyone in the Dutch Republic participated. Many of these tales were exaggerated by later writers. But for a brief period, tulip speculation reached into nearly every corner of society, and the prices climbed higher and higher, detached from all reason.

The Height of the Mania

By late 1636 and early 1637, tulip prices reached astonishing levels. A single bulb of a rare variety could be worth as much as a grand house on the canals of Amsterdam. The most coveted bulbs, such as the Semper Augustus, were whispered about like treasures of kings.

The market frenzy was fueled not by gardeners or connoisseurs but by speculators who often never touched the bulbs at all. Contracts were traded, sold, and resold, each buyer hoping to pass it on for a profit. It was not the tulip itself that mattered anymore, but the belief that someone else would pay more tomorrow.

It was, in every sense, a bubble.

The Crash

In February 1637, the bubble burst. At an auction in Haarlem, buyers suddenly failed to appear. Perhaps the prices had risen too far, or perhaps fear spread that the market could not sustain itself. Whatever the reason, confidence collapsed.

Within weeks, tulip prices plummeted. Contracts that had been worth fortunes were suddenly worthless. Those who had invested heavily faced ruin, their dreams of easy wealth turning to dust. The tulips, still in the ground, bloomed as they always had, but the frenzy was over.

Some lost everything, though not as many as the legends suggest. The Dutch government intervened to soften the blow, allowing contracts to be voided for a fraction of their original price. But the shock lingered, and the story of Tulip Mania took root in Europe’s imagination.

Myth and Reality

Tulip Mania has often been described as a madness that gripped an entire nation, but modern historians caution against exaggeration. The most famous stories, like sailors mistaking bulbs for onions or families selling mansions for flowers, may have been embellished or invented by later satirists.

Yet the essence of the tale remains true. For a brief moment, tulips became objects of wild speculation, their prices soaring beyond reason. And when the bubble burst, it revealed the dangers of greed, speculation, and the human tendency to believe that tomorrow’s prices will always be higher than today’s.

The Symbolism of Tulips

Even after the crash, tulips remained beloved in the Netherlands. They never lost their beauty or their cultural significance. Gardens continued to bloom with their colors, and the Dutch remained masters of horticulture. But the story of Tulip Mania became a moral tale, repeated for centuries as a warning against speculation and excess.

In paintings of the Dutch Golden Age, tulips often appear as vanitas symbols, reminders of the fleeting nature of wealth and life. Just as a flower blooms brightly and withers quickly, so too do fortunes rise and fall.

Tulip Mania and Modern Parallels

The legend of Tulip Mania has echoed through time, invoked whenever markets behave irrationally. From the South Sea Bubble of the 18th century to the stock market crashes of the 20th and 21st centuries, tulips are remembered as the first great cautionary tale of speculative frenzy.

Economists debate the scale of the impact, but the metaphor endures. When Bitcoin surged in value, some compared it to tulips. When housing markets overheated, the ghost of Haarlem’s auction was invoked again. Tulip Mania became shorthand for the timeless truth: markets are driven as much by emotion as by logic.

Flowers and Folly

Tulip Mania was more than an economic episode; it was a mirror of human nature. In the elegance of a flower, people saw wealth, status, and dreams of fortune. In the rush of speculation, they ignored reason, driven by the hope of quick profit. And in the inevitable collapse, they were reminded that beauty and wealth are fragile, as fleeting as the bloom of a tulip in spring.

Today, tulips still bloom across the Netherlands, a national symbol of beauty and resilience. But their history carries a darker shadow — a story of the world’s first market bubble, when houses were sold for flowers, and when a single bulb could make or break a man’s fortune.

It is a story that still speaks to us, centuries later, for the petals of Tulip Mania may have fallen long ago, but the seeds of speculation remain forever in human hearts.

Comments